Get In Touch

Call Now

+125 (895) 658 568

Quick Email

info.help@gmail.com

Office Address

Being financially responsible involves putting practical financial wisdom into action. Some of these clichés include curbing spending, paying off debt, and saving early and consistently. Compound interest can work in your favor, but it’s important to understand that the effects of saving may not be as impressive as they once were.

The economic landscape has changed significantly over the past two decades. In the past, higher interest rates allowed individuals to grow their money through strategies like investing in certificates of deposit (CDs). However, interest rates have plummeted in recent years, and this trend is expected to continue according to the Federal Reserve. While saving is still important, it’s necessary to explore alternative ways to grow your money and combat the impact of inflation in a low-interest-rate environment. Consider the following strategies:

There’s no denying the reality: interest rates are currently low, which means your investments may not perform as well as they would have in the past, even with the power of compound interest. Additionally, combating the effects of inflation poses another challenge. However, as a young investor, you have the advantage of time.

Even with low-yield investment products, significant wealth can be generated over long periods, typically spanning decades. It’s crucial to maintain realistic expectations when setting long-term savings goals.

While retiring on your own island may be highly unlikely, with foresight and planning, your investments can still provide a comfortable retirement and peace of mind.

The disparity between the rich and the poor often stems from the difference in financial education. Wealthy individuals possess knowledge that the average person lacks, particularly when it comes to making money work for them.

For many of us, the struggle lies in not knowing how to make money work, leading us to work hard for money instead. Understanding how money works is key.

Money works through the concept of interest rates, which can be divided into two types: simple interest and compound interest.

Example: 1% interest on the principal per year.

100 (principal savings)

After 1 year: 101

After 2 years: 102

After 100 years: 100 becomes 200! Exciting!

Understanding the magic of compound interest:

Example: 1% interest compounded annually

100 (principal savings)

After 1 year: 101

After 2 years: 102.01 (because your 1 peso also earns 1% interest)

After 3 years: 103.03 (the magic of compounding!)

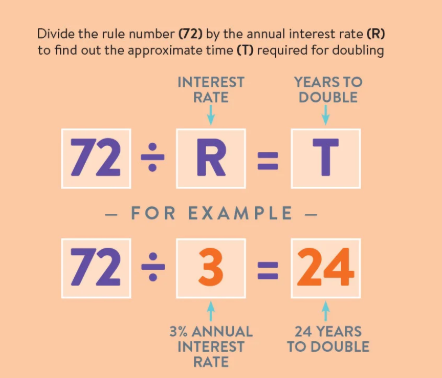

Experts have derived a simple formula to estimate the number of years your money doubles through compounding called the “Rule of 72.” The rule states that 72 (constant) is divided by the interest rate per year equates to the number of years your money will double.

Using the values above, 72 / 1% = 72 years.

Therefore: 100 becomes 200 after 72 years (compared with 100 years in simple interest rates)

Another interesting thing to note about the magic of compounding: small changes in the interest rate = millions in the end result of your savings.

Example: 100,000 invested in 4%, 8% and 12% at age 29. Using the rule of 72, the number of years your money will double is 18, 9 and 6 years, respectively. At retirement age of 65, see the big difference below.

Obviously, the bigger the interest, the bigger the result. But the not so obvious beauty of compounding is, the difference between 4 and 8% is 2 times but the difference of 400K and 1.6M is four times! The difference of 4 and 12% is thrice but the difference of 400K and 6.4M is 16 times!!! Now that is very powerful!